Frequently asked questions

Long Service Leave is state based which means that depending on the state the employee works in, employers in those states can face penalties due to LSL underpayments.

For example, under the Long Service Leave Act 2018 (VIC), if an employer is found guilty, the Court may order the employer to pay the outstanding long service leave entitlement to the employee and may also mandate the payment of interest.

Australian businesses are under more pressure than ever to maintain and demonstrate workforce compliance. Non-compliance with LSL can result in unexpected costs, legal consequences and damage your business. No matter the intent, underpaying workers can lead to public scrutiny, damage to reputation, penalties, decreased employee morale and lack of trust in the employer.

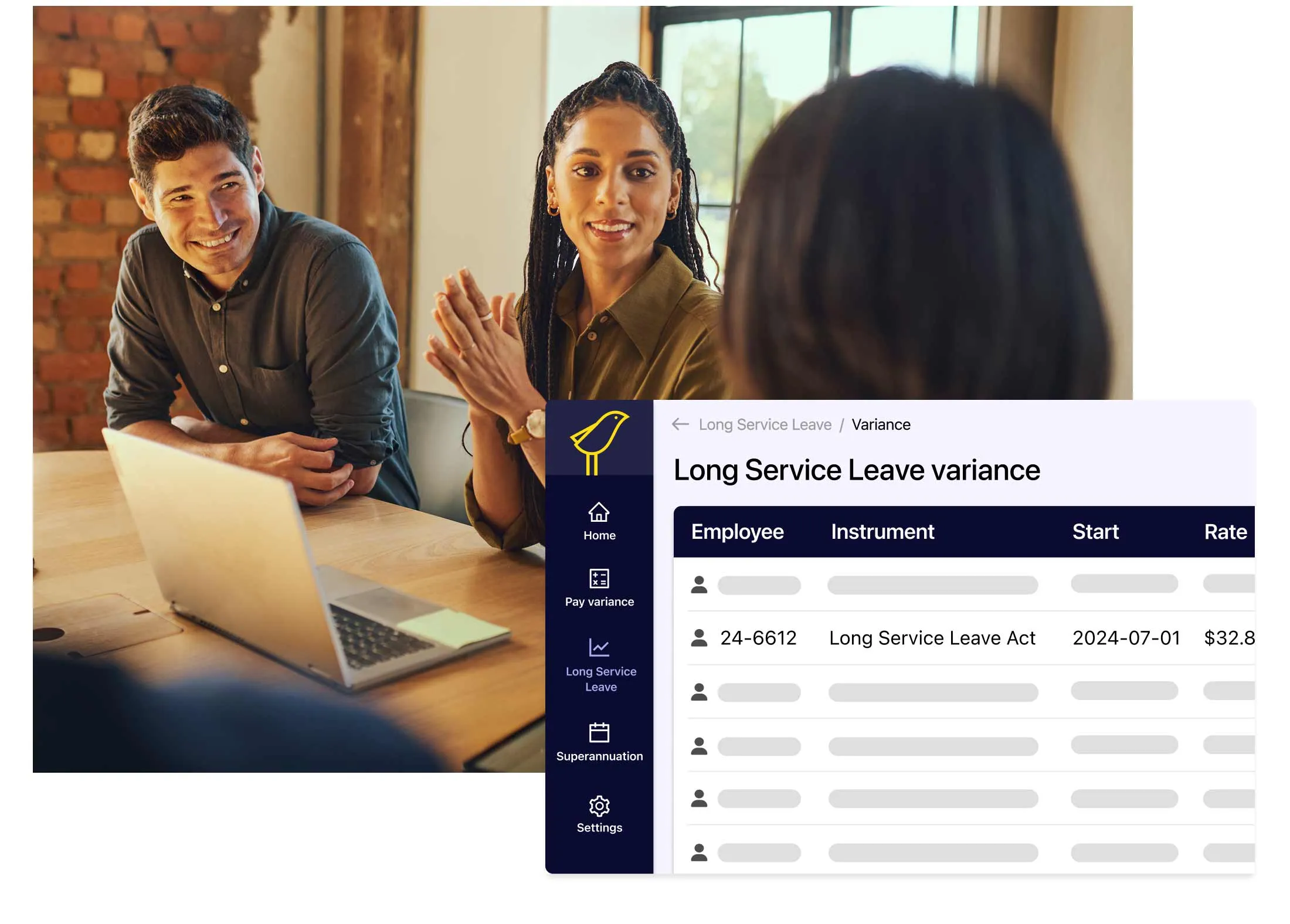

Yellow Canary's market-first LSL compliance tool is the only automated solution on the market that accurately calculates LSL balances and payments according to Australian state legislation and industrial instruments.

Our product continuously updates to reflect any changes as state-based LSL legislation develops and navigates how rules apply and interact, removing the stress of errors and manual calculations. Additionally, employers can identify LSL discrepancies after each pay run, so you can quickly resolve errors and prevent the escalation of long-term and costly issues.

Providing visibility on under and overpayments, our platform empowers large employers with invaluable insights to address non-compliance, reduce operational costs and optimise payroll processes. Aside from LSL, our platform utilises automation technology to support historical reviews and ongoing compliance across various areas, including Modern Awards and Enterprise Agreements.

Yes, it does. Yellow Canary’s LSL compliance tool gathers essential employee information, such as the start date of employment, employment status and work patterns. It then determines the employee’s eligibility based on continuous service and calculates the total length of service by converting the years of service into weeks. By multiplying the weekly accrual rate by the total weeks of service, our tool can accurately determine the employee's LSL entitlement in weeks.

Yes, it does. Our technology is integrated with all Australian states and is designed to adapt to new state-specific LSL legislation. We continuously update our product to reflect any changes as laws develop.

Our LSL compliance tool offers comprehensive data management including the storage and integration of employee information and historical employment data. This gives accurate insight when identifying previous underpayments and overpayments of LSL for remediation projects.

Our LSL compliance tool provides real-time monitoring and adaptability to LSL requirements. It provides analytics of LSL to help employers anticipate changes and adjust compliance criteria, minimising the risk of LSL non-compliance.

This proactive, automated approach creates a framework where compliance remains consistent and reliable across various employee scenarios, improving or maintaining overall organisational efficiency, risk management and employee morale.

We recommend conducting a historical LSL review initially to ensure that balances for any Always on Compliance are accurate and correct. This will position you and your company optimally for ongoing compliance.

Yellow Canary's Always on Compliance package or solution empowers businesses to achieve this objective by utilising automation to update balances and detect and resolve payment variances monthly. This is helpful for businesses to future-proof their ongoing workforce compliance.

We understand that every employer has unique needs and requirements. To make sure we provide the best solution tailored to your specific situation, we prefer to discuss your needs in detail with you first. This allows us to offer a pricing structure that aligns perfectly with the value and support your business will receive from our solutions. Get started here.